The Best Payday Advance Apps in 2025

Do you need quick access to money before your paycheck arrives?

Finding reliable payday advance apps is the best solution in such a situation.

Why choose payday advance apps over traditional payday loans?

Traditional payday loans often come with sky-high interest rates and hidden fees. On the other hand, cash advance apps offer a safer, faster, and more transparent way to access funds. Instead of being trapped in debt cycles, these apps provide features like:

- Instant cash advances without credit checks

- Budgeting tools to track spending

- Low or no fees for borrowing small amounts

- Direct deposits to your bank account

By using the right payday advance app, you can cover emergencies, avoid overdraft fees, and bridge the gap until your next paycheck.

In this guide, we review the best payday advance apps that help you borrow money instantly, avoid high-interest payday loans, and manage your finances smarter.

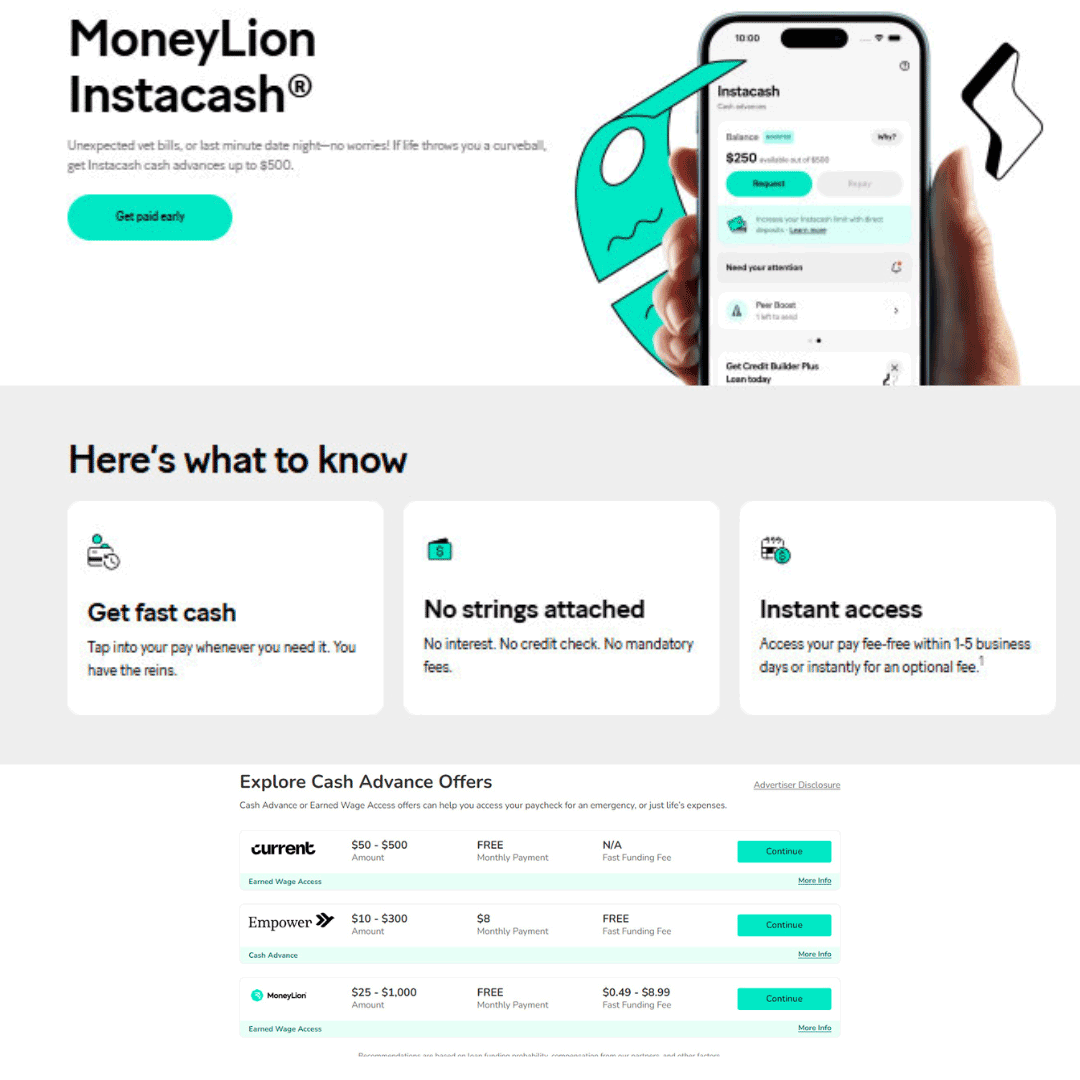

MoneyLion

- A payday Advance with Banking & Credit Builder

- MoneyLion is more than just a cash advance app.

- It offers Instacash advances up to $500, plus a credit builder loan and online banking services.

- Advance Limit: Up to $500

- Fees: Free for standard delivery, express fee applies

- Unique Feature: Integrated credit-building and investing

- If you want a payday advance solution with all-in-one financial services, MoneyLion is a top pick.

Brigit

- The Best Payday Advance App for Budgeting and Cash Advances

- Brigit offers up to $250 in instant cash advances with no credit check.

- What sets Brigit apart is its AI-powered financial tools, which predict upcoming expenses and help prevent overdrafts.

- Advance Limit: Up to $250

- Fees: $9.99 monthly subscription

- Unique Feature: Financial insights and budgeting alerts

- Brigit is perfect if you want both cash advances and financial planning tools in one platform.

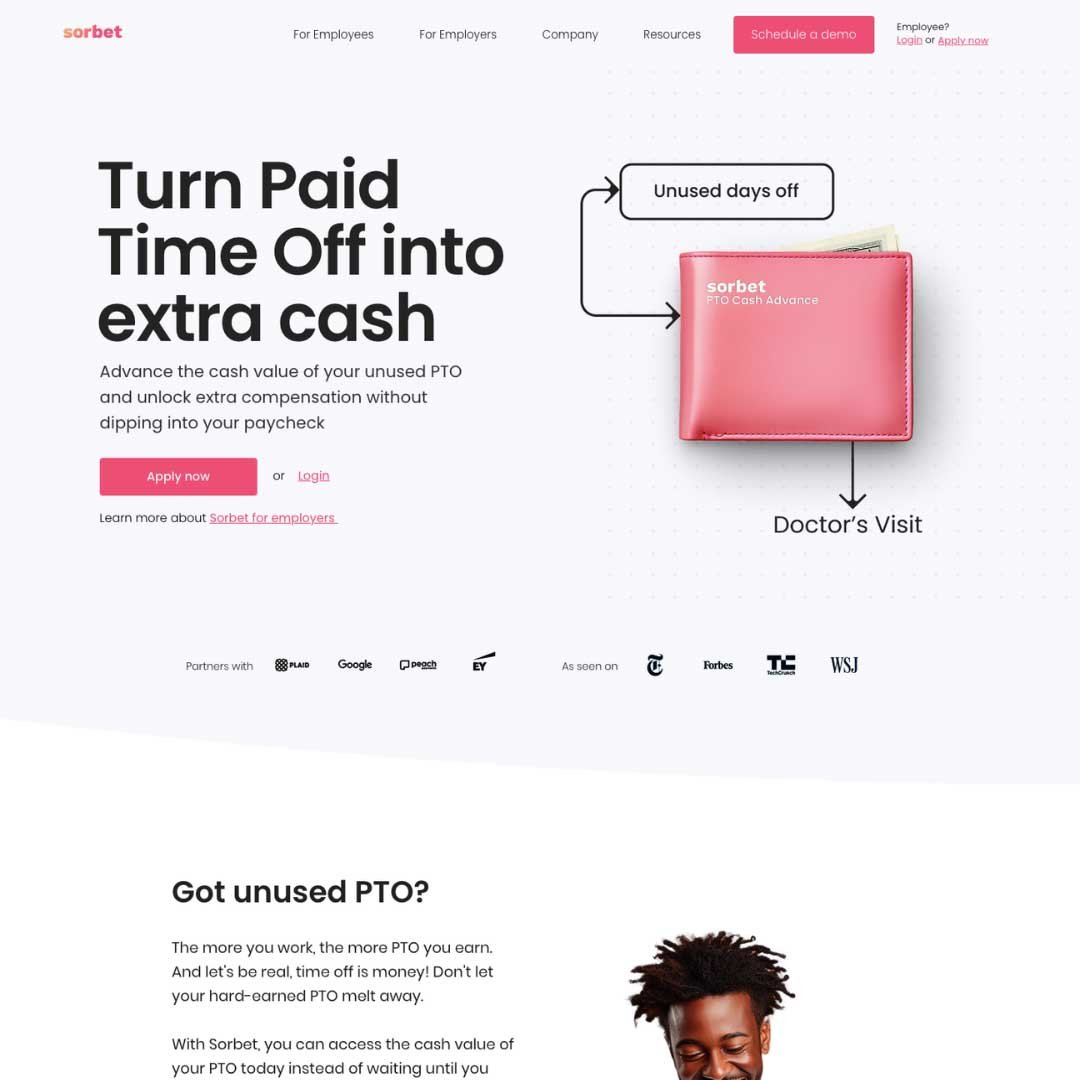

Sorbet

- The Best Cash Advance App for PTO Conversion

- Sorbet helps employees unlock the cash value of their unused paid time off (PTO). Instead of waiting until resignation or year-end, you can convert unused leave days into instant cash.

- Advance Limit: Varies depending on accrued PTO

- Fees: No upfront fees (employers typically cover costs)

- Unique Feature: Converts PTO into spendable cash

- Sorbet is ideal if you want to turn unused leave into immediate funds without taking a loan.

Zippy Loan

- Best for Personal Loan Flexibility

- Zippy Loan connects borrowers with lenders offering quick payday advances and personal loans ranging from small amounts to larger sums.

- Advance Limit: $100 to $15,000 (depending on lender approval)

- Fees: Varies by lender and loan terms

- Unique Feature: Broad loan amounts and flexible repayment terms

- Zippy Loan is perfect if you need anything from a small payday advance to a larger emergency loan.

- Check out other Loan Sites similar to Zippy loan here on this comprehensive post.

LendYou

- Best for Fast Online Payday Loans

- LendYou offers access to lenders providing payday advances and installment loans online with a fast approval process.

- Advance Limit: $100 to $2,500

- Fees: Varies by lender and repayment plan

- Unique Feature: Quick application and wide lender network

- LendYou works well if you need money fast and prefer a simple online application with multiple lending options.

Quick Cash Advance

- Best for Simple Payday Loans in Emergencies

- Quick Cash Advance provides straightforward payday advance loans online, with quick approvals and easy eligibility.

- Advance Limit: Up to $1,000

- Fees: Varies depending on loan terms

- Unique Feature: Focused purely on payday cash loans

- Quick Cash Advance is a good fit if you want a fast, no-frills payday loan for urgent expenses.

Empower

- Best for Instant Cash Advance and Budgeting Support

- Empower provides up to $250 instantly with no late fees or interest.

- The app also includes spending trackers and personalized financial coaching.

- Advance Limit: Up to $250

- Fees: $8 monthly subscription

- Unique Feature: Cash advance + personalized budgeting support

- Empower is a solid choice if you want instant money and long-term financial guidance.

Varo

- Offers Payday Advance solutions with Full-Service Mobile Banking

- Varo is a mobile banking app that also provides cash advance services.

- With Varo, you can access up to $100 early, and higher limits unlock over time.

- Advance Limit: Up to $500

- Fees: $3 to $5 depending on the advance amount

- Unique Feature: Full-service online banking + advance option

- Varo is ideal if you want a bank account and cash advance app combined.

In conclusion, payday advance apps have become a powerful alternative to payday loans because they give users instant access to money without predatory interest rates.

Whether you prefer budgeting-focused apps like Brigit, all-in-one financial tools like MoneyLion, or flexible paycheck access with Varo, there’s an option for every lifestyle.

Choosing the right cash advance app means balancing convenience, fees, and financial features that help you not only get money fast but also improve your long-term financial health.